The Impact of Fed Rate Cuts on Mortgage Rates: What Investors Need to Know

When the Federal Reserve cuts interest rates, many expect mortgage rates to drop immediately — but the reality is more complex. This article explains how Fed decisions truly affect mortgage rates, what factors influence their movement, and what homebuyers and investors should watch for in today’s changing economy.

Why Flexible Financing Terms Matter More Than Ever in a High-Rate Market

In today's real estate market, interest rates remain elevated—and for many residential investors, that creates a more challenging landscape. Whether you're managing multiple projects, planning a long-term hold, or actively flipping properties, the structure of your financing can be just as critical as the deal itself.

Beyond the Rate: Why Smart Terms Make Stronger Investments

In real estate investing, the lowest rate isn't always the best deal. Experienced investors know that smart loan terms—matched to your hold period, exit strategy, and project scope—can make or break a deal.

At Rock East Funding, we work with investors who understand that real success comes from knowing how to structure a deal to fit their overall strategy, not just chasing the lowest number.

Building a Diversified Real Estate Portfolio: Balancing Risk & Reward

Real estate investing presents a valuable opportunity to build wealth, generate passive income, and establish financial security. However, like any investment, it comes with risks. A well-diversified real estate portfolio can help investors manage those risks while optimizing returns. By spreading investments across different property types, locations, and strategies, investors can create a resilient portfolio that withstands market fluctuations.

Leveraging Location to Enhance Property Value and Rental Income

Location is the cornerstone of real estate success. A well-chosen location can drive demand, increase property value, and maximize rental income. But selecting the right area is just the first step—what you do with the property in that location determines your returns. This blog explores strategically enhancing your investment by capitalizing on location-based advantages.

How to Understand Local Trends to Make Smarter Real Estate Investments

Understanding local real estate trends is essential for any investor looking to stay ahead of the market. The more in tune you are with your chosen market's dynamics, the better you can predict where the market is headed—and adjust your strategy accordingly. Here’s a closer look at key local trends and how you can use them to refine your investment decisions.

Howto Find Hot Markets for Real Estate Investing in 2025

When it comes to real estate investing, selecting the right market is critical to achieving long-term success. A property’s location often determines its desirability, appreciation potential, and rental income. So, how do you identify locales with high potential? Focusing on key indicators like economic growth, population trends, and infrastructure development.

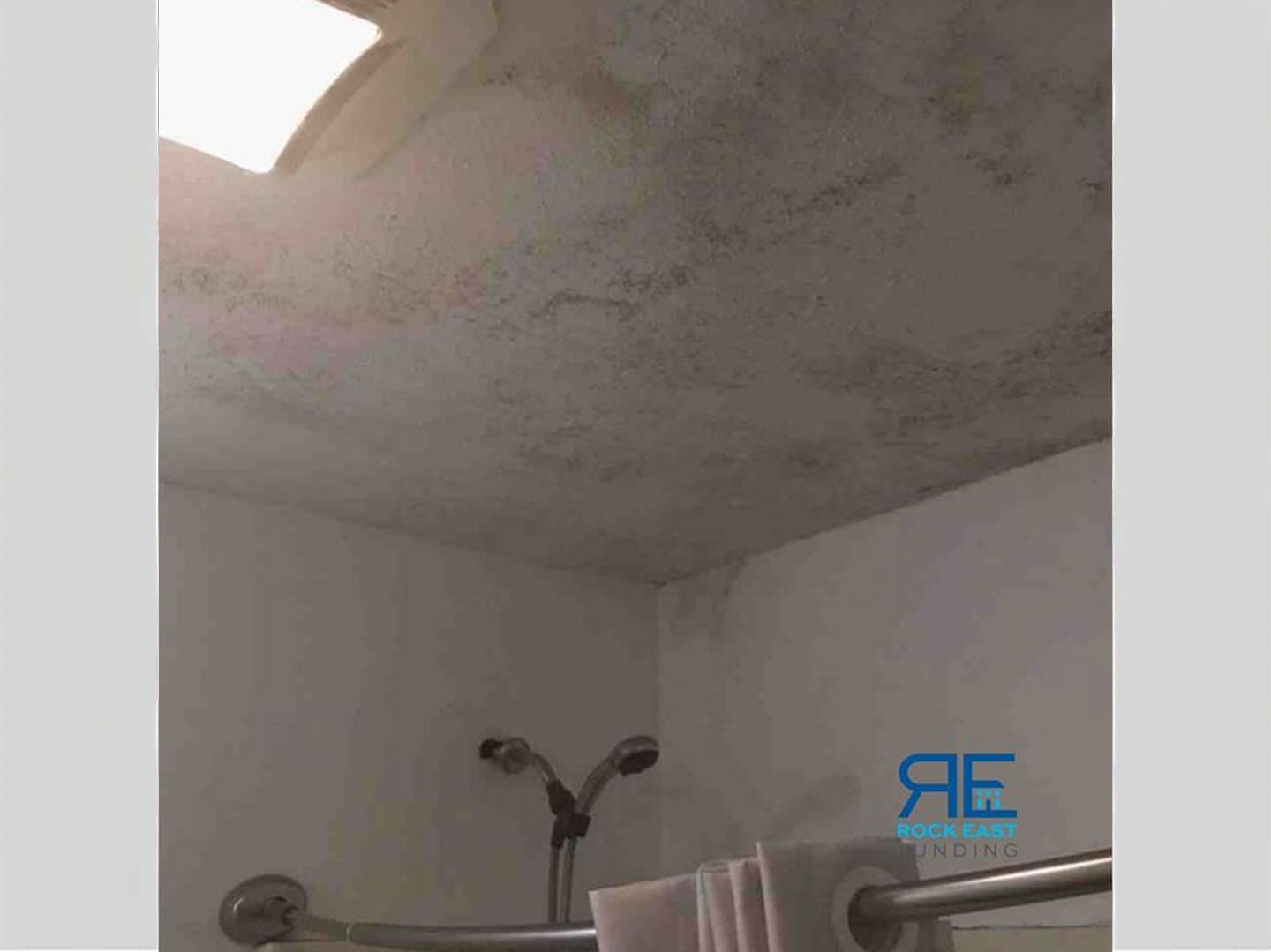

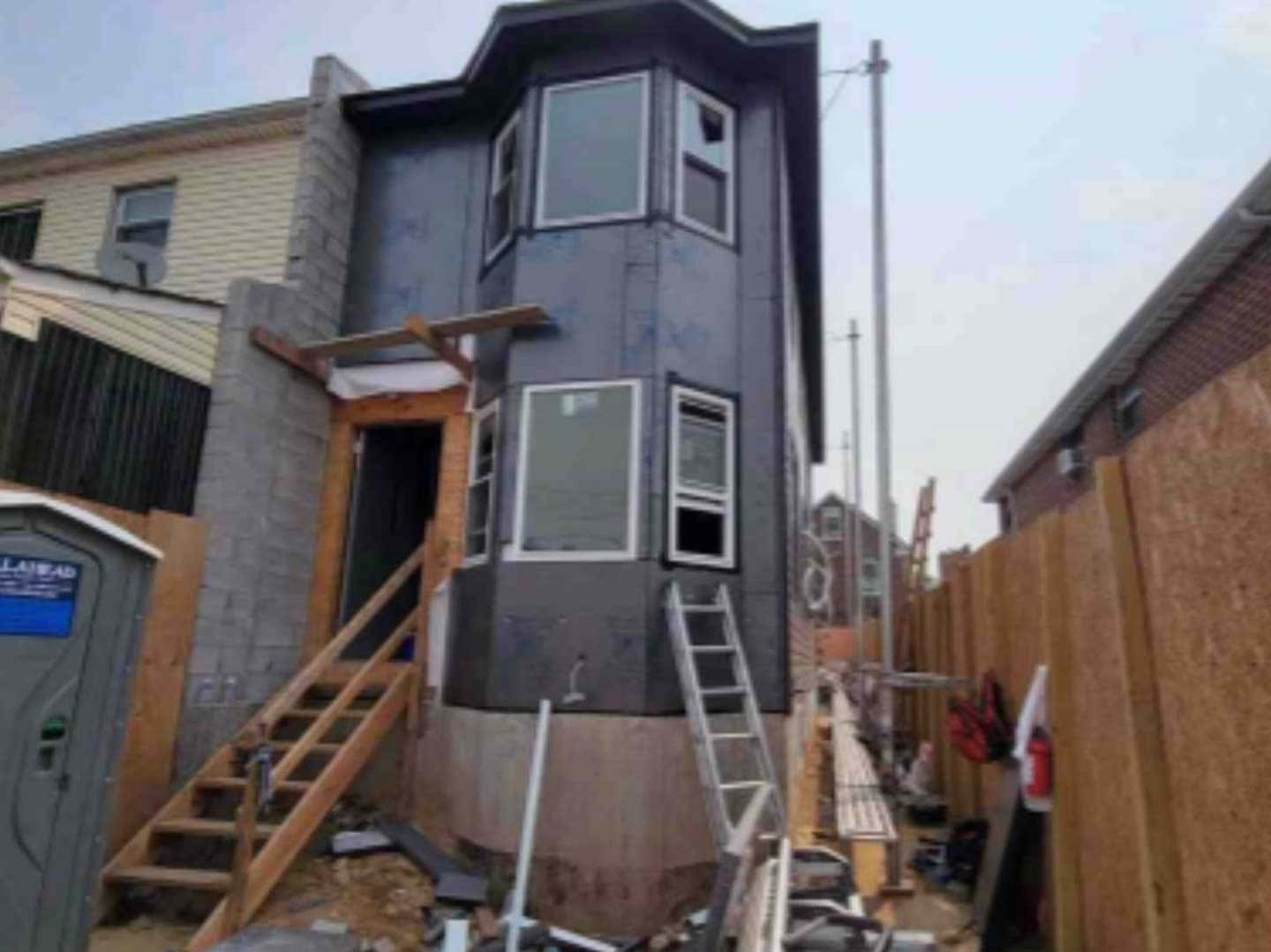

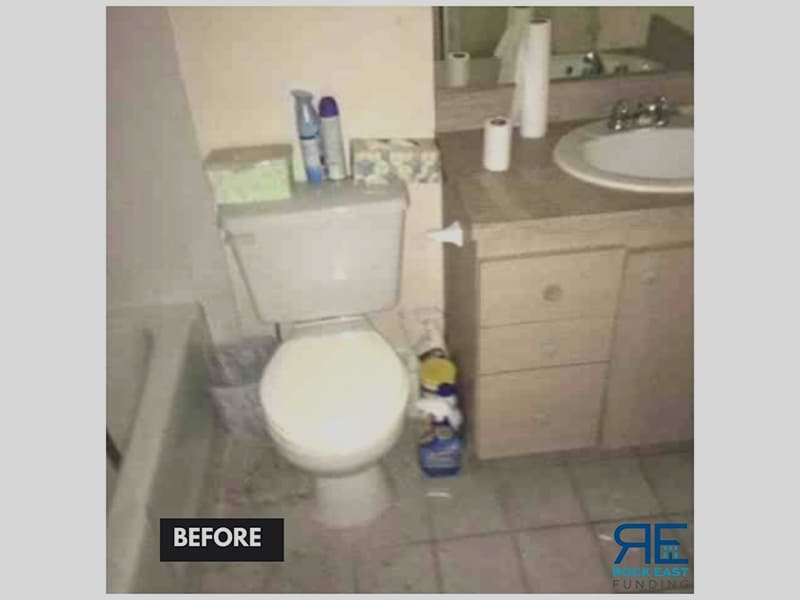

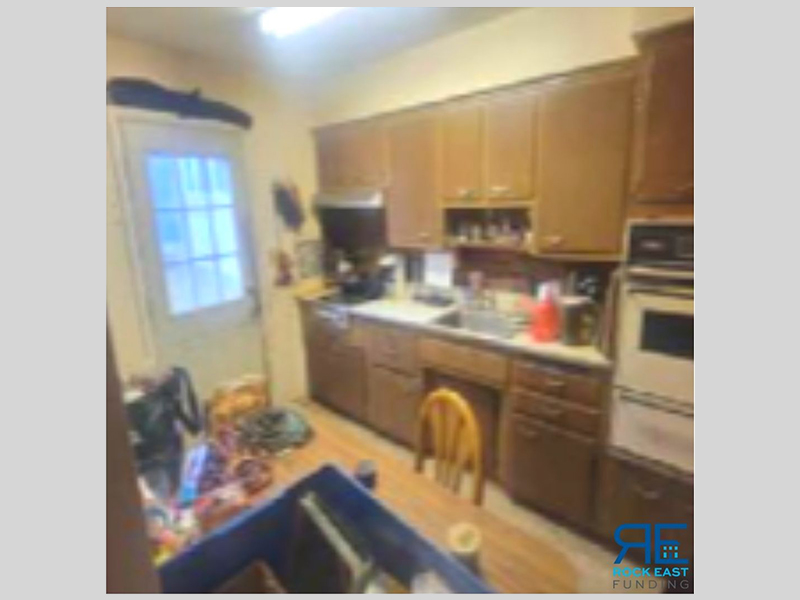

Boost Property Value in NY and NJ: High-ROI Renovations

Renovations can increase a property's value and increase the profit from a sale or rental. Knowing which upgrades offer the best returns is essential for real estate investors, fix-and-flippers, and rental property owners in New York and New Jersey.

Here, we explore the high-impact renovations that can significantly increase a property's value and provide tips to avoid common pitfalls.

Understanding Builders Risk Insurance for Real Estate Investors

Having the right insurance coverage is crucial when embarking on a real estate investment project, especially those involving significant renovations. Builders risk insurance is a specialized property insurance designed to cover buildings under construction or renovation.

Here's a comprehensive guide on what you need to know about builders' risk insurance to protect your investment.

Sustainable Real Estate Investing: Earth Month Insights

The real estate landscape is evolving, with a notable shift towards sustainability. As Earth Month comes to a close, it's an opportune time to explore why sustainable real estate investments are environmentally responsible and financially savvy.

This blog dives into the growing trend of integrating renewable energy sources, the market demand for energy-efficient properties, and how sustainable features contribute to long-term investment stability and resilience for residential real estate property investors.

Maximizing Your Real Estate Investment Potential: Top 3 Financial Strategies

Spring is here, and for property investors, it's more than just a season of tidying up physical spaces. It's the perfect time to refresh and revitalize your financial strategies for the year ahead.

At Rock East Funding, we recognize the significance of preparing your financial foundation to seize the opportunities in the real estate market. Here are some essential spring cleaning financial strategies tailored specifically for property investors:

Private Money Lenders: Boosting Real Estate Investors in Volatile Times

In the ever-evolving real estate landscape, in a market where unpredictability is the norm, private money lenders emerge as essential allies, providing the crucial elements of speed and agility. Seasoned investors understand that success hinges on adaptability and strategic financial partnerships.

Unlocking the Secrets of Real Estate Investment Metrics

When it comes to making the right choice in real estate investment, there's a lot more to think about than just the property's price and rental income potential. Experienced investors rely on a set of carefully refined tools and calculations to guide them. These tools are not just for risk reduction but also for maximizing returns.

In the following sections, we'll explore some critical metrics that serve as invaluable compass points, steering astute real estate investors through the complex landscape of property options and enabling them to make informed decisions.

Unlocking Success: Must-Have Insurance Coverages for Landlords in the New York-New Jersey Area

As a real estate investor, safeguarding your assets is of paramount importance. After all, your property is not just a building; it's an income-generating investment that deserves optimal protection.

As a licensed agent in Property Casualty insurance, I've outlined some crucial coverages to help you navigate the complexities of insuring your investment properties.

Cracking the Code: Understanding Real Estate Loan Types

I recently attended a small gathering of real estate investors where the topic turned to confusion about the types of lenders, and loans, available. As a lender, I myself find there is an ever-increasing alphabet soup of names being used in the industry. Private lenders, Hard Money Lenders – what’s the difference, or is there a difference?

Sustainable and Eco-Friendly Strategies for Property Investors in the US

Real estate is a significant contributor to global carbon emissions, accounting for about 40% of energy-related carbon dioxide emissions. As such, real estate investors are beginning to recognize the benefits of implementing sustainable and eco-friendly strategies in their portfolio. By doing so, they can not only contribute to a more sustainable future but also save money -- a win-win situation!

Three Reasons to Consider DSCR Loans for Your Rental Properties

As banks tighten their requirements and underwriting becomes even more difficult, more and more investors are considering DSCR loans for their rental properties. In most ways, a DSCR loan is very similar to a commercial bank loan. One difference is that they are usually a little bit more expensive than bank loans, but in many scenarios the benefits outweigh the cost.

Secret to Success: Rock East’s Guiding Principles

While 2022 was a tumultuous year in the real estate investing industry, we are extremely proud that it was a record-setting year at Rock East Funding. While other lenders pulled back, or even disappeared, our clients continued to count on us to help them achieve their goals.

Why does Rock East continue to thrive? We believe it’s because we continue to stay true to the principles that have guided us since Alan first started lending more than 30 years ago. We have always stayed true to those principles, and we always will.

When others are leaving the market it can be a great time to jump in

Rising interest rates, falling property values, uncertain rents. Added together, these can make any investor nervous and reluctant to buy more properties. However, all of these factors can also mean it’s the perfect time to continue investing. I’ve worked with small and large real estate investors, and here are three reasons why I think it’s a good time to be cautious, but not necessarily a time to be scared.

3 Tips for Real Estate Investing in a Rising Interest Rate Environment

In real estate investing circles, it’s the most asked question these days: “In a rising interest rate environment, do I buy a rental property?” As a lender, who clients often turn to for advice, I’ve been attending conferences, webinars and reading a lot of articles to “get smarter” on the topic. Unfortunately, I can’t give you a definitive answer, but I can give you a few things to consider that really resonate with me...

3 Things You Need to Know About Appraisals for Your Real Estate Investment

Just like banks who provide mortgages for people buying a home to live in, most private lenders, who finance real estate investors, require an appraisal on a property before making a loan. The appraisal is used to protect the lender – it helps them evaluate if it’s a good deal for the investor and the appraised value is also usually used to set the maximum loan amount. I have been doing appraisals for private lenders for over 10 years. During that time on many occasions the appraisal has differed significantly from the borrower’s estimate of value. Often times this is because the investor does not fully understand how appraisers select the comparable sales used to value the property. If you understand these three things about appraisals, it will help you evaluate your deals...

3 Common Myths About Hard Money Lenders

When I joined Rock East Funding about five years ago and started meeting investors, I got one of two reactions when I met investors. The first reaction was “Oh great, you’re a lender. Tell me about your terms.” The other reaction was the opposite – “ohhh….you’re a hard money lender.” That reaction was from people who felt it’s a “shady” business where investors get “ripped off.”

Like any industry, unfortunately, there certainly are unscrupulous players in the Hard Money industry. However, if you are working with a reputable lender, Hard Money can be key to fueling your growth and success.

So, let’s dispel some of the Hard Money Myths.

Going Green: Making Eco-Friendly Real Estate Investments

More and more real estate investors are considering making their projects more “green” not just to protect the environment but also to protect their wallet. If you’re going to hold the property as a rental, you can save on energy costs by investing in energy efficiency appliances. If it’s a flip, you can increase resale value by making your project more green with some of the tips below.

The biggest challenge investors face when trying to make their real estate fix and flip more environmentally friendly is simply not knowing where to start. In addition, many people think making a project green is expensive and difficult, but in reality, there are a number of simple and affordable ways to reduce your environmental impact.

What Does the Fed’s Interest Rate Hike Mean for Real Estate Investors?

While the pandemic inflicted unprecedented losses on many businesses, one sector that did not follow that trend was residential real estate. The market both nationwide and here in the New York area continues to be red hot — largely as city dwellers move to the suburbs and the surge in demand has put the existing inventory of suburban homes in short supply.

Although finding an investment property can be difficult right now, it’s also an opportunity to make big profits - multiple sources including Bloomberg, CNBC, and Forbes report profits on flips are at a record high. And it’s an especially good opportunity for those who have insider’s knowledge like contractors and realtors. I know first-hand – as an investor and contractor, I have renovated and flipped more than 180 properties in my career.

Top Strategies to Limit Real Estate Investor Tax Liabilities

When lenders are deciding whether to make a loan to real estate investors, they really only want to know one thing – am I putting my money in a project that is likely to succeed? Everything a lender asks you is designed to answer that question.

As one of the most experienced Hard Money lenders in the industry, we know what questions to ask to determine if a deal is likely to be successful. In fact, we know the questions most other lenders will ask as well.

Below are the five questions we always ask about the investor and their deal. By knowing these questions ahead of time, you can be prepared before you reach out to a lender. And when you do talk to a lender, you’ll demonstrate that you are prepared for the investment and increase your chances of getting the funding you need!

5 Questions Hard Money Lenders Ask Their Real Estate Investor Clients

When lenders are deciding whether to make a loan to real estate investors, they really only want to know one thing – am I putting my money in a project that is likely to succeed? Everything a lender asks you is designed to answer that question.

As one of the most experienced Hard Money lenders in the industry, we know what questions to ask to determine if a deal is likely to be successful. In fact, we know the questions most other lenders will ask as well.

Below are the five questions we always ask about the investor and their deal. By knowing these questions ahead of time, you can be prepared before you reach out to a lender. And when you do talk to a lender, you’ll demonstrate that you are prepared for the investment and increase your chances of getting the funding you need!

How to Achieve Your Real Estate Investing Goals in 2022

Becky Nova is a Cancer Researcher by day, Real Estate Investor. After taking time away from the hospital, Becky lived in Spain and Portugal where she owned a Tour Company and then a bar, respectively. Unfortunately, she lost the bar and moved back to the States penniless. It was then that she met her now husband, Emilio. Emilio had immigrated to the United States a few years before and dreamt of Homeownership. In an attempt to not live mortgage payment to mortgage payment, Becky suggested they purchase a multifamily.

Although finding an investment property can be difficult right now, it’s also an opportunity to make big profits - multiple sources including Bloomberg, CNBC, and Forbes report profits on flips are at a record high. And it’s an especially good opportunity for those who have insider’s knowledge like contractors and realtors. I know first-hand – as an investor and contractor, I have renovated and flipped more than 180 properties in my career.

The Impact of Supply Chain Disruptions on Real Estate Construction and Renovations

While the pandemic inflicted unprecedented losses on many businesses, one sector that did not follow that trend was residential real estate. The market both nationwide and here in the New York area continues to be red hot — largely as city dwellers move to the suburbs and the surge in demand has put the existing inventory of suburban homes in short supply.

Although finding an investment property can be difficult right now, it’s also an opportunity to make big profits - multiple sources including Bloomberg, CNBC, and Forbes report profits on flips are at a record high. And it’s an especially good opportunity for those who have insider’s knowledge like contractors and realtors. I know first-hand – as an investor and contractor, I have renovated and flipped more than 180 properties in my career.

Financing Fix and Flips: How Hard Money Lending Fuels Real Estate Investing

While the pandemic inflicted unprecedented losses on many businesses, one sector that did not follow that trend was residential real estate. The market both nationwide and here in the New York area continues to be red hot — largely as city dwellers move to the suburbs and the surge in demand has put the existing inventory of suburban homes in short supply.

Although finding an investment property can be difficult right now, it’s also an opportunity to make big profits - multiple sources including Bloomberg, CNBC, and Forbes report profits on flips are at a record high. And it’s an especially good opportunity for those who have insider’s knowledge like contractors and realtors. I know first-hand – as an investor and contractor, I have renovated and flipped more than 180 properties in my career.

Attention Realtors and Contractors: There’s Never Been a Better Time to Consider House Flipping

While the pandemic inflicted unprecedented losses on many businesses, one sector that did not follow that trend was residential real estate. The market both nationwide and here in the New York area continues to be red hot — largely as city dwellers move to the suburbs and the surge in demand has put the existing inventory of suburban homes in short supply.

Although finding an investment property can be difficult right now, it’s also an opportunity to make big profits - multiple sources including Bloomberg, CNBC, and Forbes report profits on flips are at a record high. And it’s an especially good opportunity for those who have insider’s knowledge like contractors and realtors. I know first-hand – as an investor and contractor, I have renovated and flipped more than 180 properties in my career.

Covid’s Effects on Real Estate Investing

Here we are, over one year since the world changed as a result of the COVID pandemic. But what a difference a year has made! Vaccines are now widely available, fewer restrictions are in place, and commerce and industry are on the upswing.

So what does the emergence from Covid mean for real estate investors looking to grow their portfolios? No doubt, there is a shortage of properties for investors due, in part, to federal and state regulations to protect families from foreclosures and evictions, along with an extension on mortgage payment forbearance. Right now the search for property can be frustrating but for the diligent, patient investor, opportunity awaits!

WHO WE ARE

Privacy Policy

OUR SERVICES

Contact Us

info@rockeastfunding.com

Phone: 516-775-8800

Fax: 917-677-8909

Social Media

Long Island Address:

670 Long Beach Blvd.

Long Beach, NY 11561

Westchester Address:

520 White Plains Road, Suite 500

Tarrytown, NY 10591