While the pandemic inflicted unprecedented losses on many businesses, one sector that did not follow that trend was residential real estate. The market both nationwide and here in the New York area continues to be red hot — largely as city dwellers move to the suburbs and the surge in demand has put the existing inventory of suburban homes in short supply.

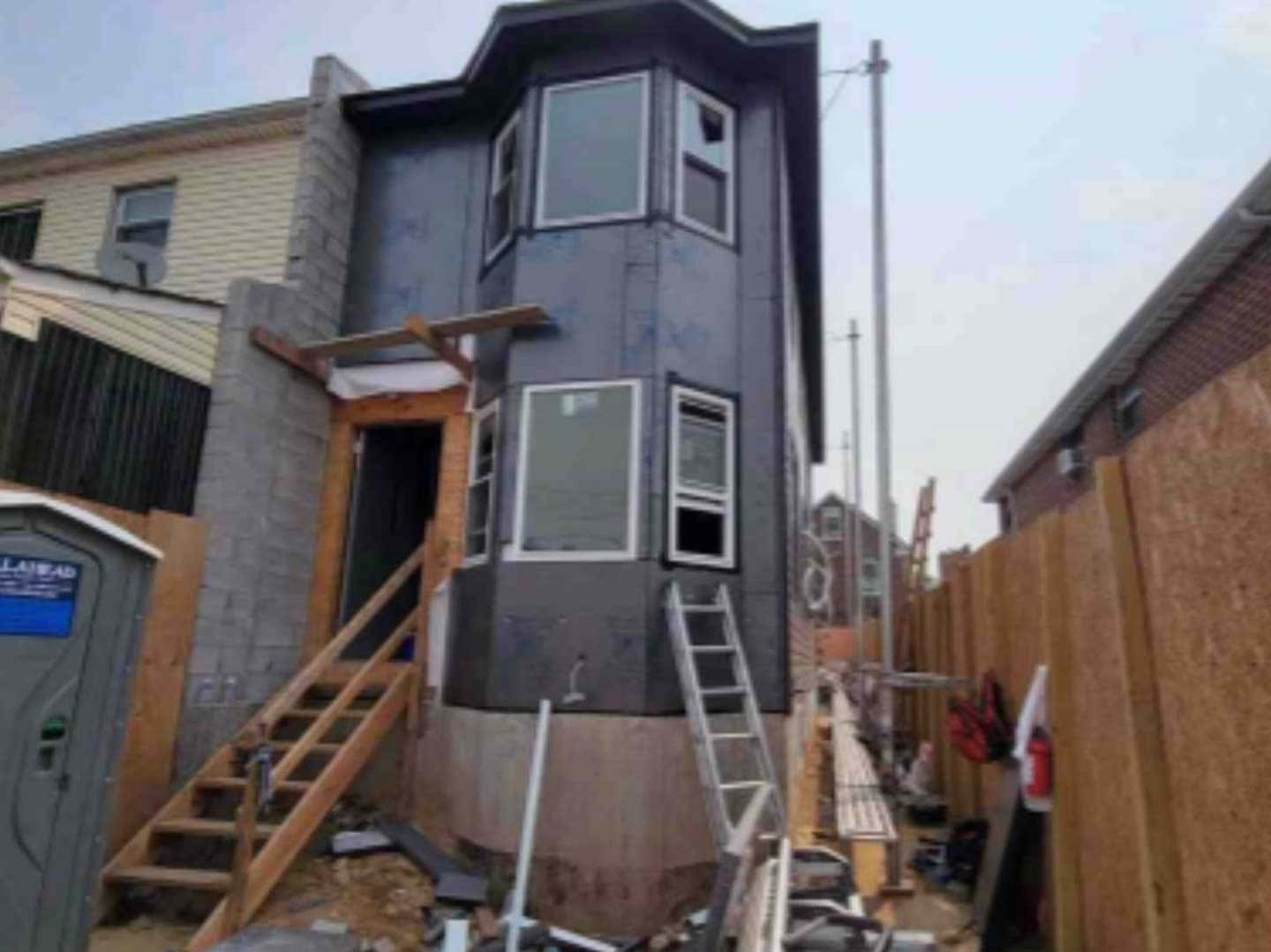

Although finding an investment property can be difficult right now, it’s also an opportunity to make big profits – multiple sources including Bloomberg, CNBC, and Forbes report profits on flips are at a record high. And it’s an especially good opportunity for those who have insider’s knowledge like contractors and realtors. I know first-hand – as an investor and contractor, I have renovated and flipped more than 180 properties in my career.