5 Questions Hard Money Lenders Ask Their Real Estate Investor Clients

When lenders are deciding whether to make a loan to real estate investors, they really only want to know one thing – am I putting my money in a project that is likely to succeed? Everything a lender asks you is designed to answer that question.

As one of the most experienced Hard Money lenders in the industry, we know what questions to ask to determine if a deal is likely to be successful. In fact, we know the questions most other lenders will ask as well.

Below are the five questions we always ask about the investor and their deal. By knowing these questions ahead of time, you can be prepared before you reach out to a lender. And when you do talk to a lender, you’ll demonstrate that you are prepared for the investment and increase your chances of getting the funding you need!

#1) What type of loan are you looking for?

Rock East, and many other Hard Money Lenders, offer a variety of loans. Do you know what type of loan you need for your project?

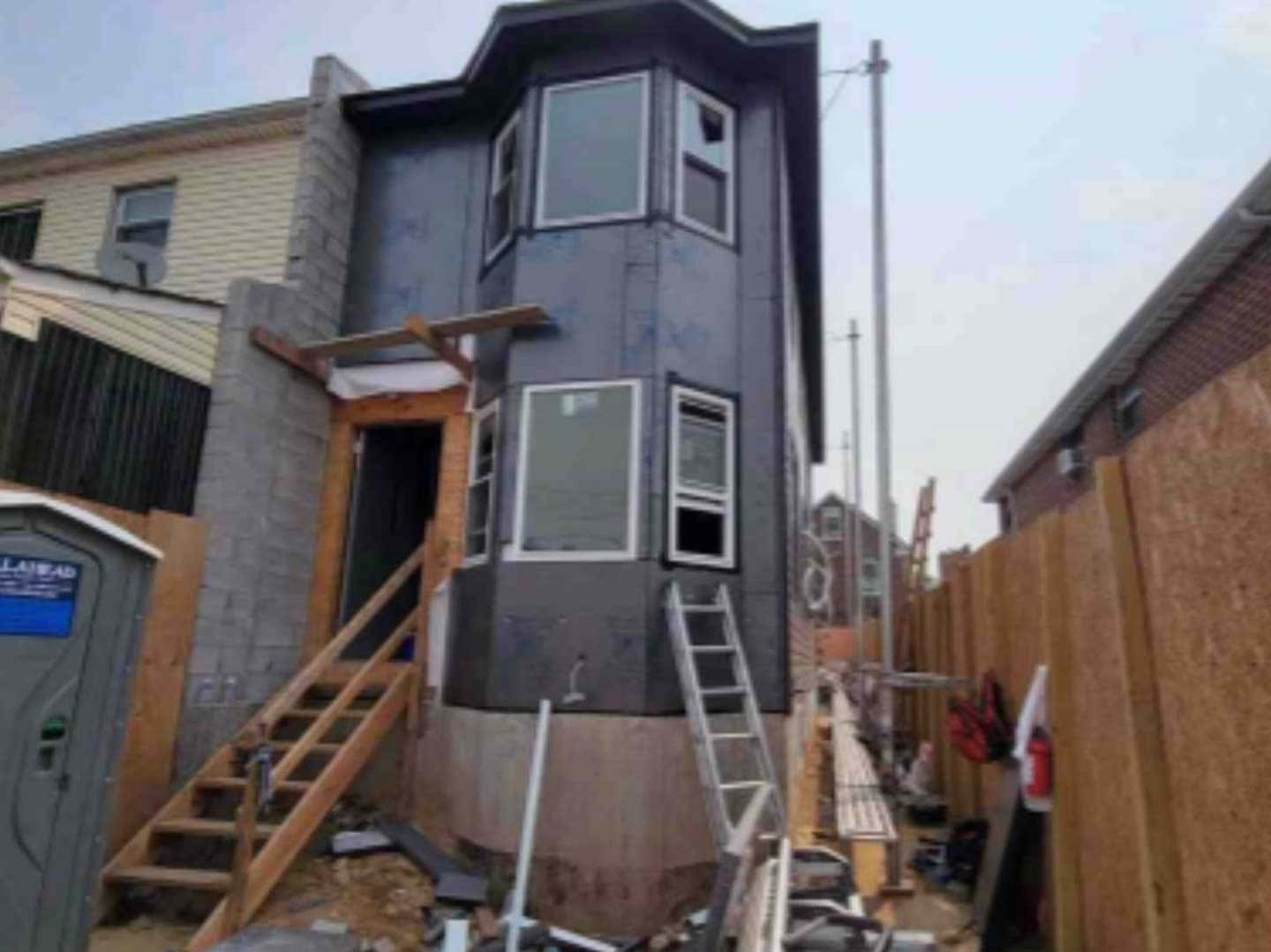

- Rehab loans: These are most commonly referred to as “fix and flip” loans and are used for buying and fixing up a distressed property. These are usually short term (up to one year) and have higher interest rates.

- Bridge loans: This loan is for those who have their money tied up in a property that is just about ready to be sold. But now you found another property to buy and they don’t have the money – you need financing to “bridge” until your first property sells. These are usually very short-term loans – a few weeks to a few months. But they usually are not necessary if you took a Rehab loan.

- DSCR Term loans: These loans are similar to traditional bank loans and can be used to purchase, or refinance, a property that is occupied by renters. Unlike traditional bank loans which take into account the borrower’s financial position and require tax returns, W-2’s, etc., DSCR loans are based solely on the property’s cash flow and the borrower’s credit score. As a result, they can close in as quick as 30 days. Like a bank loan, the term is usually 30 years.

The following questions relate specifically to Rehab Loans.

#2) What type of real estate investing experience do you have?

The most accurate predictor of success in real estate investing is prior experience, so we want to know about that. Did you just watch HGTV and decide to become an investor? Are you a realtor, an appraiser, a contractor or do you have other relevant experience? Borrowers should be honest and up-front about their experience – even if they are new to the business. If you don’t have experience, there are options such as putting more of your own money in the deal and/or paying a higher interest rate. But not being straight forward is a great way to ensure you don’t get a loan.

#3) How much money do you need?

There is a balance when lenders decide on the size of the loan. Many investors are looking for the maximum loan amount because they want to be able to do multiple deals. That works for an experienced investor with a proven track record. But we also want to know how you are going to make your interest payments during the loan. What kind of income do you have? What’s your monthly cash flow?

If you are less experienced, you will need to put more of your own money into the deal so keep that in mind. And don’t take on a “gut renovation” as a first project – start with a more cosmetic renovation.

#4) What is the ARV of the property?

The After Repair Value will be a key factor as a lender decides whether to do the loan and, if so, how much to lend.

While an appraisal will be required to determine the ARV, an accurate assessment of the value by the investor shows they know what they are doing. Have you done your due diligence, and can you show that your project pencils out?

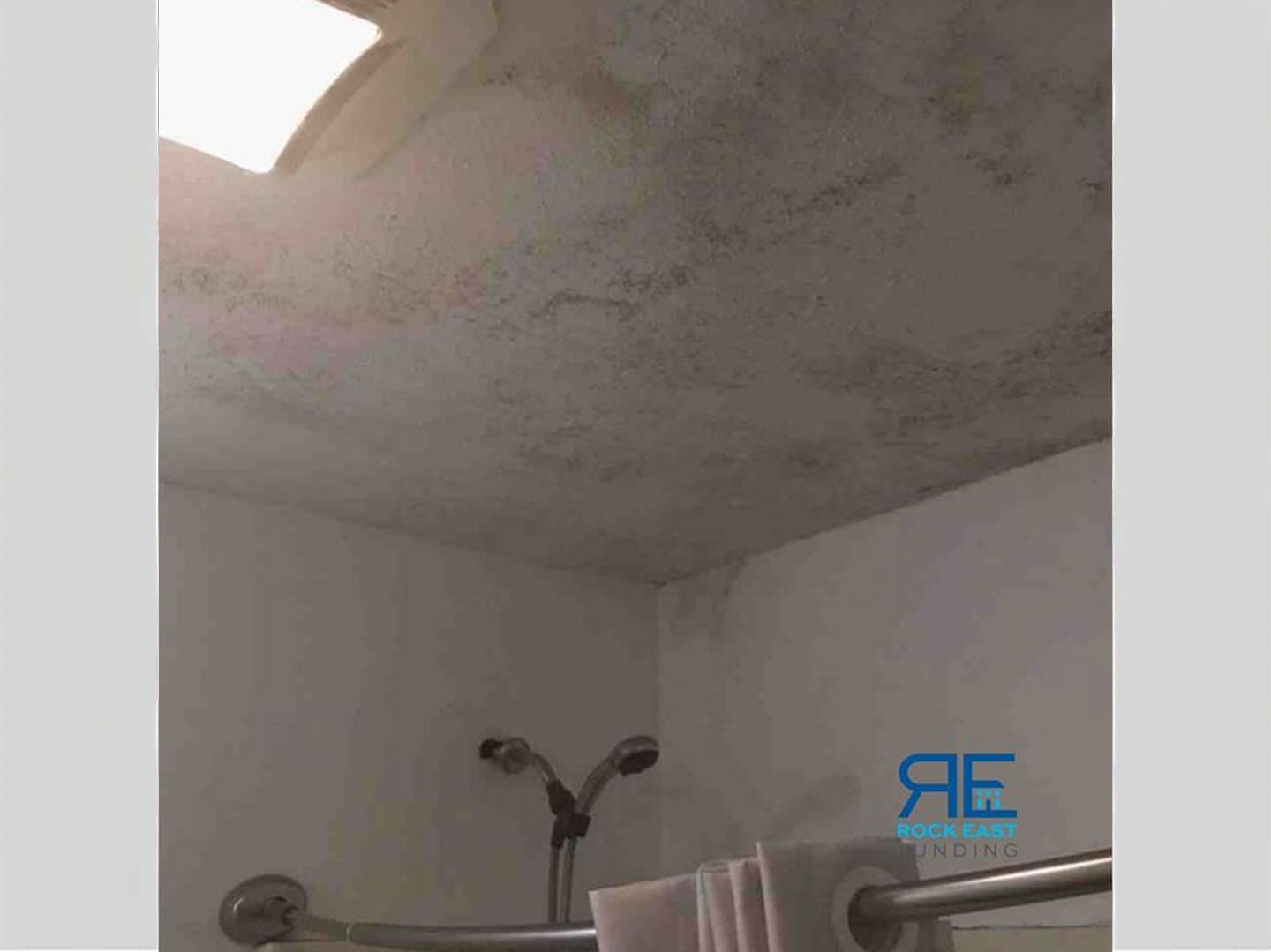

#5) What is the project’s scope of work/budget?

The lender will want a detailed renovation budget because that budget, combined with your purchase price and holding costs, are the factors that determine if the deal makes sense. Evaluating your budget will also help the lender determine if you are a savvy investor. Do you have a good sense of how much a new roof costs? How much do new kitchen cabinets cost? Is the budget too low-end, too high-end, or just right for the market?

If you can provide solid answers to these questions, you are probably in a good position to get a loan for your investment. Let us assist you with the next steps – contact us today!

##