Three Reasons to Consider DSCR Loans for Your Rental Properties

As banks tighten their requirements and underwriting becomes even more difficult, more and more investors are considering DSCR loans for their rental properties. In most ways, a DSCR loan is very similar to a commercial bank loan. One difference is that they are usually a little bit more expensive than bank loans, but in many scenarios the benefits outweigh the cost.

These are the key reasons our clients often turn to DSCR loans:

- Simplified underwriting – If you don’t know, DSCR stands for Debt Service Coverage Ratio. These types of loans are based on the cash flow of the property, not the guarantor’s financial situation. This makes underwriting much simpler – no tax returns, no W2’s, etc. In addition, while credit scores are factored in, DSCR lenders don’t look at the guarantor’s Debt to Income ratio.This is a very important advantage for investors who own multiple properties.This simplified underwriting means that we can typically go from application to closing within 30 days.

- Higher Loan To Value and Predictable terms – For cash-out refinances, our DSCR loans go as high as 75% LTV. On purchases, most DSCR lenders go as high as 80% LTV. Even in “calm” times, most commercial lenders don’t go that high on LTV – and now many are lowering the LTV. In addition, we offer a 30-year fixed rate option. Most conventional lenders are doing shorter terms with complicated amortization schedules and balloon payments. (30 year fixed is not the only option but it’s the most popular option.)

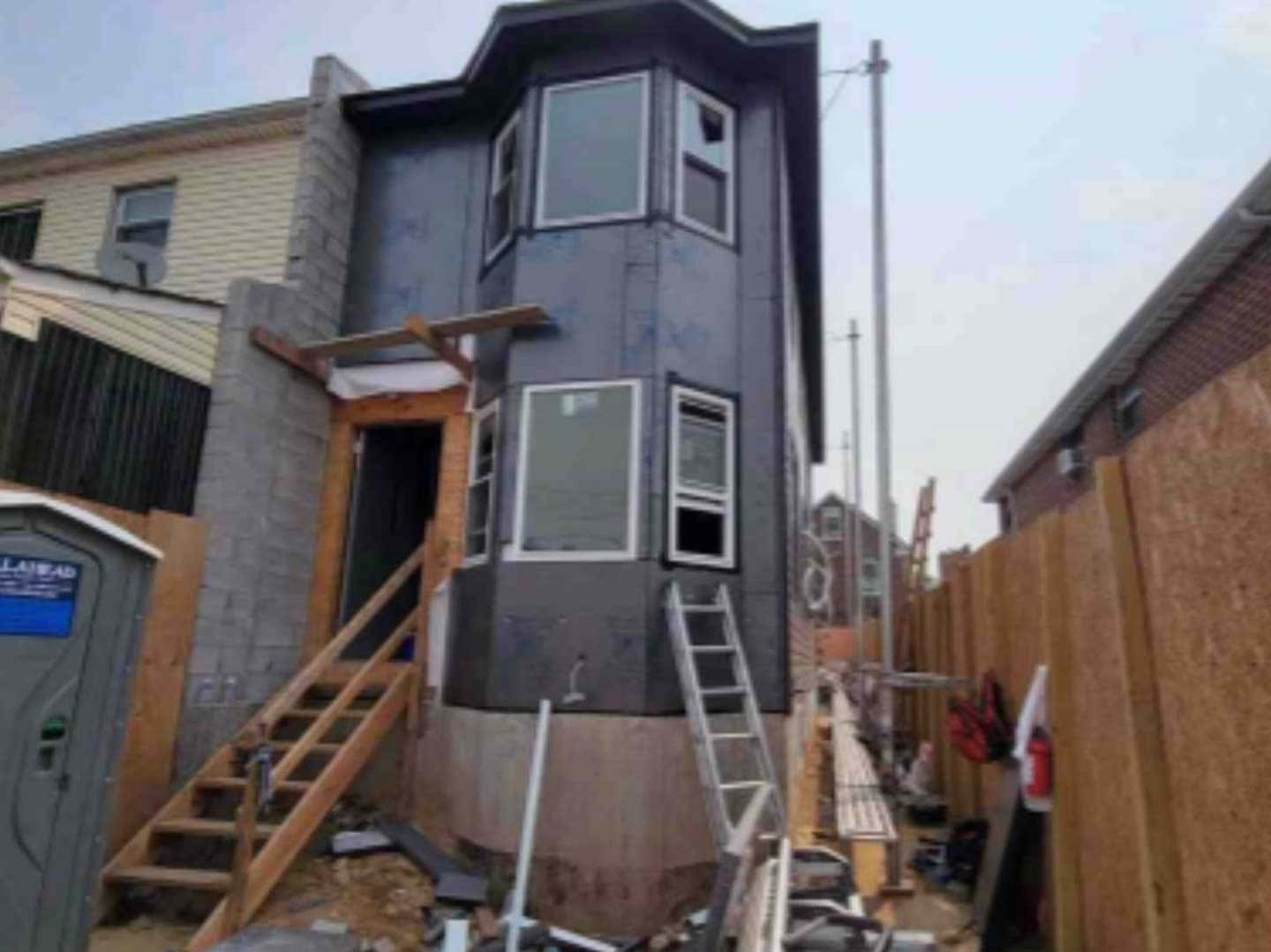

- Minimal Seasoning – To get 75% cash out, an investor has to own the property for just three months. This is a huge advantage for any investor, but especially for investors who buy distressed properties, renovate them and force appreciation. In many deals an investor can get all of their cash out of the deal – plus additional cash – in just 90 days.

We always advise our clients to look at every alternative – in some cases traditional bank financing is a great option. But more and more investors are turning to DSCR loans to get quick closings and maximum leverage.

*Stacey Andreola has been originating loans for Rock East Funding since 2019 and has been a private loan originator for almost a decade.