Understanding Builders Risk Insurance for Real Estate Investors

Having the right insurance coverage is crucial when embarking on a real estate investment project, especially those involving significant renovations. Builders risk insurance is a specialized property insurance designed to cover buildings under construction or renovation.

Here’s a comprehensive guide on what you need to know about builders’ risk insurance to protect your investment.

Opt for a Special Form Policy

One of the first steps in securing builders’ risk insurance is opting for a Special Form policy. This type of policy broadens the scope of coverage, providing more comprehensive protection against potential losses. With a Special Form, the likelihood of your claim being covered increases, offering you peace of mind throughout the renovation process.

Inform Your Insurance Professional About the Property’s Status

It is imperative to communicate with your insurance professional about the status of the property, mainly if it is vacant and under renovation. Properties in this condition require a builder risk endorsement. With this endorsement, you may avoid severe consequences regarding claim payments, potentially receiving significantly reduced amounts or denying claims altogether.

Ensure Contractors are Properly Insured

All contractors working on the site or your property must have adequate insurance coverage. Furthermore, it is a best practice to have the contractor name your LLC, which is handling the rehab, as an additional insured on their policy. This added layer of protection ensures that your interests are safeguarded in case of any incidents or claims arising from the contractor’s work.

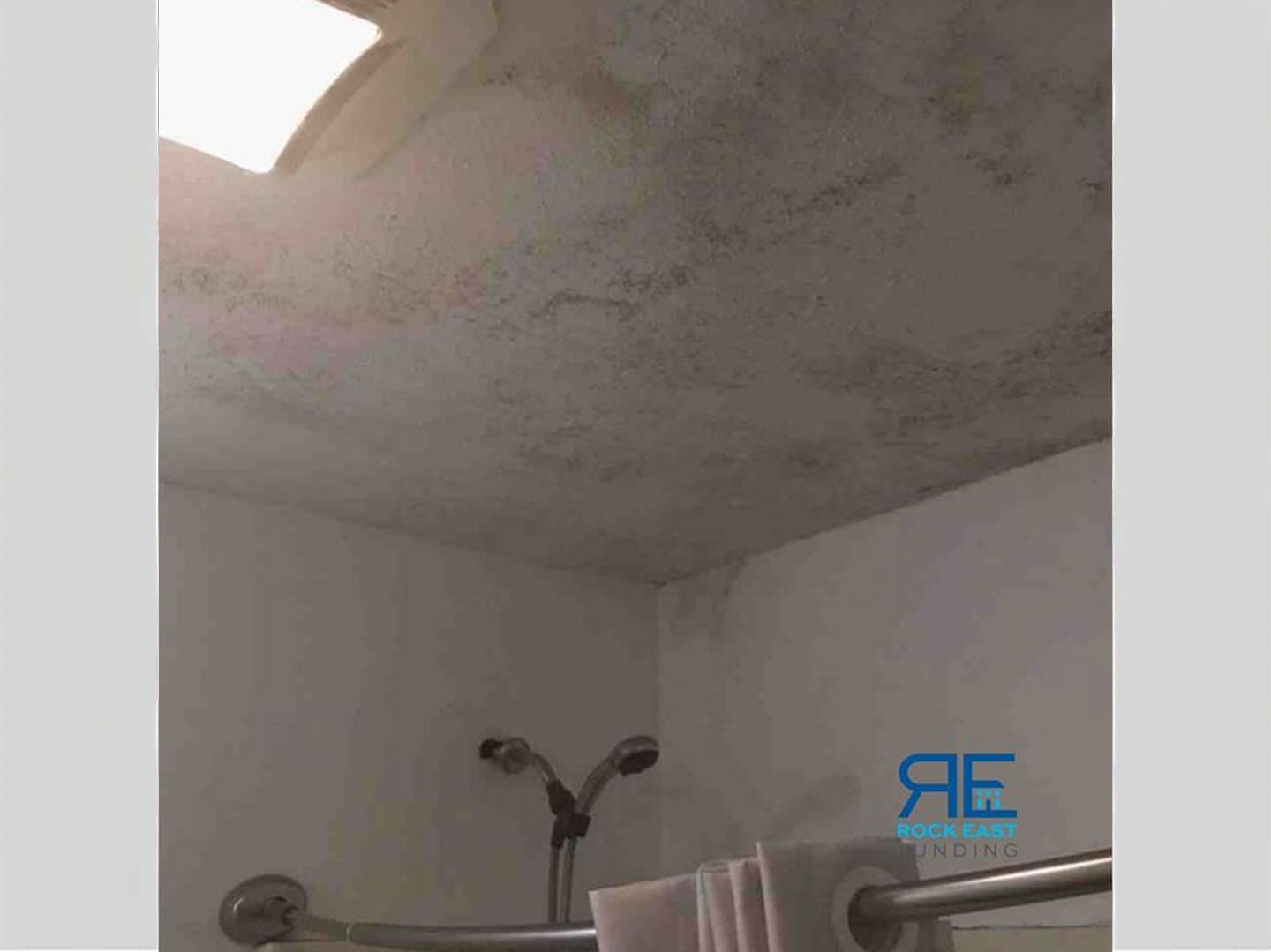

Manage Water Supply in Vacant Homes

Turning off the water supply is essential if your investment property is vacant. Many insurance policies for vacant homes do not cover claims for accidental water discharge if the house has been unoccupied for more than 59 days. By turning off the water, you mitigate the risk of water damage and avoid potential claim denials.

Understand Replacement Cost Policy Penalties

If your policy includes replacement cost coverage, verify if there are penalties for not insuring the property to its total rebuild cost. Insuring the property for less than its actual rebuild cost can reduce claim payouts, exposing you financially. Ensure that your coverage limits accurately reflect the actual cost of rebuilding the property.

Coverage for Building Materials

Builders’ risk policies generally extend coverage to all building materials on the job site, even those not installed. In the event of a loss, having receipts or bills of lading for these materials is crucial for filing a claim. Proper documentation ensures you can recover the costs of materials lost due to covered incidents.

Securing a builder’s risk insurance is critical in protecting your real estate investment. By opting for a Special Form policy, informing your insurance professional about the property’s status, ensuring contractor insurance, managing water supply, understanding replacement cost penalties, and documenting building materials, you can safeguard your investment and ensure a smooth renovation process. Always consult a knowledgeable insurance professional to tailor your coverage to your specific needs and effectively protect your investment.

##

*About Mike Milano

Mike Milano is an account executive with Eifert, French & Ketchum (EFK) Insurance & Risk Management. Mike has helped countless members of the community with their personal or business insurance needs.