Commercial Loans

What Is Entailed in a Commercial Loan?

Commercial loans, unlike residential mortgages, are not insured by a government entity, as these are largely seen as investments that carry risk. Thus, interest rates are higher. Your credit score does have an impact on your ability to obtain the loan, as well as on how high or low that interest rate will be. When applying, you must have the capital for a down payment (generally twenty percent) in addition to proof you have the cash flow to service the loan.

How Are Commercial Loans Different From Traditional Mortgages?

Commercial loans, regardless of whether you need funding for operational costs of rehabbing a property or wish to leverage equity in commercial property, are not government-backed by entities such as Fannie Mae. Due to this distinction, interest rates tend to be higher than what is common with traditional mortgages.

How Does Borrowing and Repayment Work?

At Rock East Group, creditworthiness is taken into consideration for loan approval. Additionally, in many cases the investor must provide proof — through financial statements — that there is adequate cash flow to make monthly payments, generally of interest only, each month.

Our loans are written for one year with no prepayment penalty. We have the option to extend the loan for 2 additional 6 month periods. We can fund purchase money or purchase and renovation money. Typically a down payment of twenty percent on the total cost of the project is required.

Applying for a Commercial Loan With Rock East Group

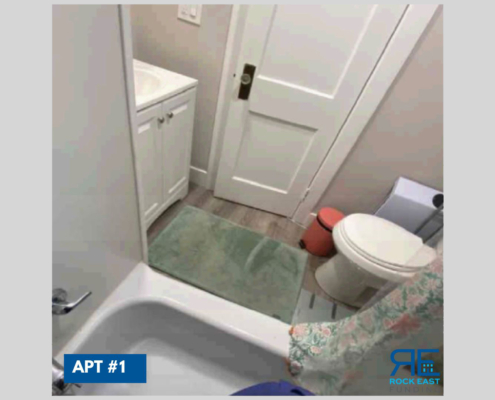

At Rock East Group, a completely family-owned company, we provide loans to experienced investors who purchase one-four family houses, apartment buildings or commercial properties Note: We do not offer loans for owner-occupied houses, malls or hotels. You can find an application for a loan right on our website. If you have any questions about the process, don’t hesitate to call us at 516-299-8425. We’re happy to answer your questions and get your loan process going in the right direction.