Cracking the Code: Understanding Real Estate Loan Types

I recently attended a small gathering of real estate investors where the topic turned to confusion about the types of lenders, and loans, available. As a lender, I myself find there is an ever-increasing alphabet soup of names being used in the industry. Private lenders, Hard Money Lenders – what’s the difference, or is there a difference?

Being in the business for more than 30 years, we have some insight into the history. Back when we started lending, a Hard Money Lender was a non-bank lender who provided short-term loans to investors who were primarily doing “fix and flip” projects. However, over the past 5-10 years, as more institutions (private equity, hedge funds, insurance companies) moved into the industry, they decided they wanted to “rebrand” the industry. Thus, a whole new set of terms was born.

It’s important for investors and lenders to have shared terminology. Here’s how I explain some of the key terms to investors I talk with.

Private Lender

For many years, a private lender typically referred to an individual, like your aunt or neighbor, who had money and would lend it to you for a real estate investment. It wasn’t a company advertising they had money available, just someone you knew. Thus, “private” lender. Over the past few years, many companies that are not banks and lend exclusively to real estate investors started referring to themselves as Private Lenders. So today a Private Lender can be either an individual or a company that is not a bank and is lending to real estate investors. (In fact, earlier this year one of the largest conferences for non-bank lenders, which was known for 20 years as “Pitbull” rebranded to the National Private Lender Association Conference.)

Hard Money Lender

Hard Money lender is interchangeable with Private Lender – it is the term that was used most often until recently as I noted above.

Hard Money Loan

This is a short-term loan used to acquire and renovate a distressed property. Rates are higher than a traditional mortgage because the lender is taking more risk, but qualifying for a Hard Money Loan is easier and faster than qualifying for a mortgage from a bank. Hard Money Loans are also often referred to as “Acquisition/Renovation” loans or “Fix and Flip loans” – same thing, different names.

DSCR Rental Loan

This product has become very popular in recent years for investors who hold, rather than flip, their properties. These are typically 30-year loans for properties that are fully occupied by rent paying tenants and monthly payments include principal and interest, just like a bank mortgage. Unlike a bank mortgage, however, they are based just on the cash flow (Debt Service Coverage Ration) of the property, not the finances of the borrower. (A solid credit score is typically required, but there are no minimum income, Debt to Income ratios, etc.)

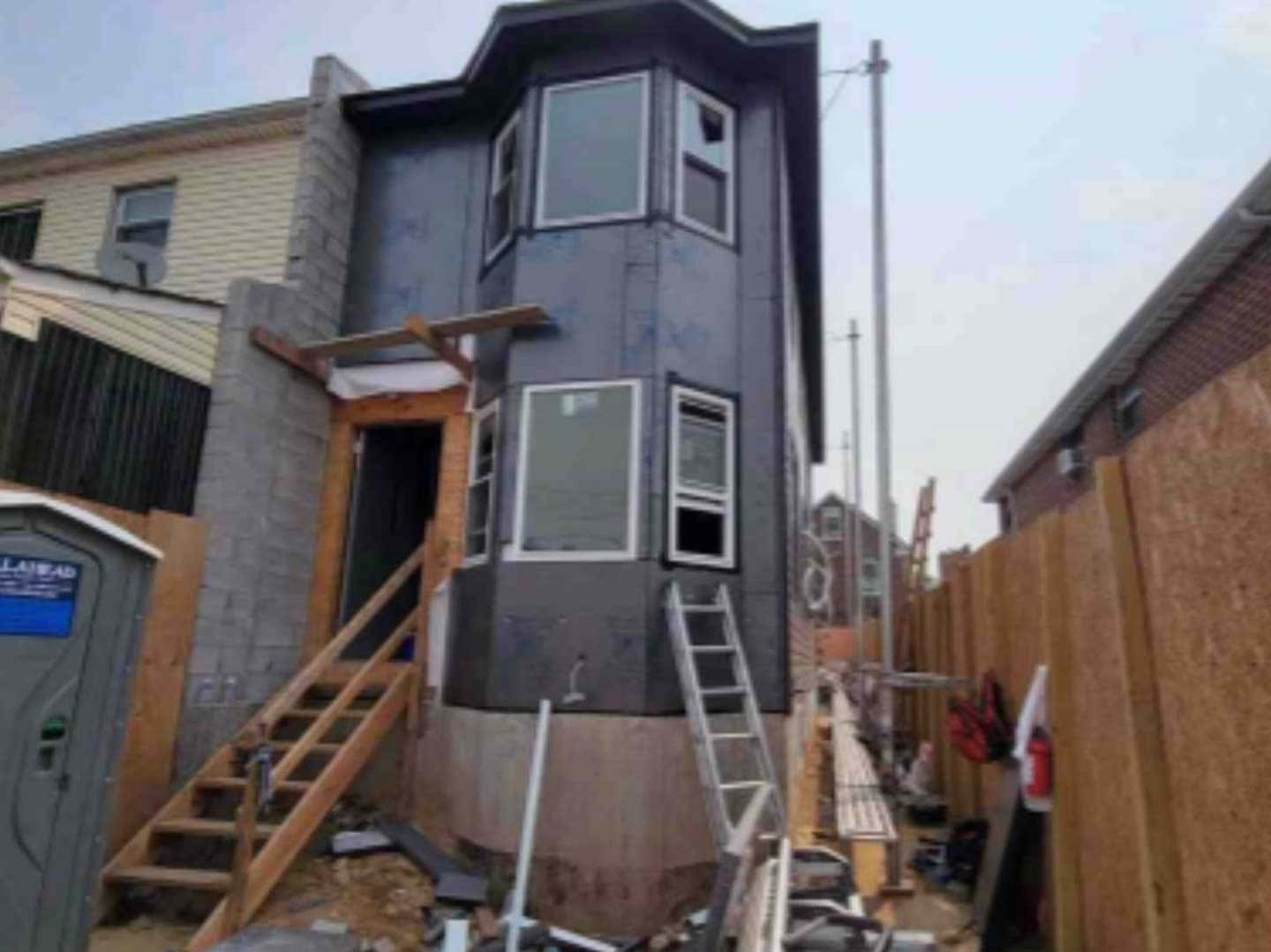

Ground Up Construction

This is similar to a “Hard Money Loan” except, like it sounds, it’s used to acquire land and build a completely new structure. Most lenders require the borrower has prior ground up construction experience to qualify for a Group Up Construction Loan.

Qualifying Mortgage

While there are a lot of technicalities to a QM loan, in general this is the traditional mortgage that you get from a bank to buy a home you will live in – these are not loans for investors. These have the best rates and can be backed or guaranteed by federal programs such as Fannie Mae and Freddie Mac. Private Lenders do not offer Qualifying Mortgages.

Non Qualifying Mortgages

Technically, loans offered by Private Lenders are Non QM loans because they don’t meet the standards of a Qualifying loan. But generally they refer to a loan for someone who is buying a home to live in but doesn’t qualify for a QM loan. Non QM loans are offered by banks.

It can be confusing. But the bottom line is that if you know what your investment goal is, a good lender should be able to help you identify the right loan – no matter what they happen to call it!